K V Kamath Committee

Kamath on restructuring of loans impacted by the covid 19 pandemic.

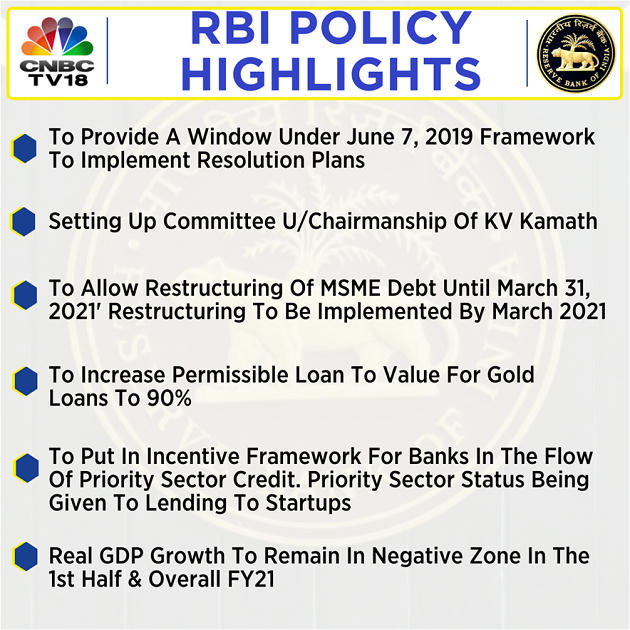

K v kamath committee. In his interview with cnbc awaaz rbi governor shaktikanta das had said that banks could extend the loan moratorium by three six or even 12 months under one time restructuring. The central bank s announcement is based on the recommendations of the k v kamath committee which submitted its report last week. The reserve bank of india rbi has set up a committee headed by k v. Kamath committee report on recommendations to bail out sectors affected by the covid 19 pandemic.

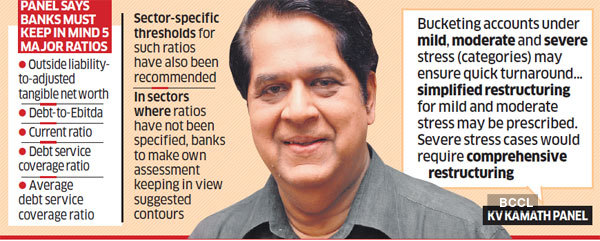

From rbi web site the reserve bank had on august 7 2020 announced the constitution of an expert committee under the chairmanship of shri k v. Leverage liquidity debt serviceability. Kamath led committee released its report on monday web desk september 07 2020 23 38 ist the committee appointed by the reserve bank of india rbi on monday released its report on loan restructuring as part of the resolution framework for covid 19 related stress identifying 26 sectors that lending institutions should consider when determining resolution plans for borrowers. On september 4 the k v kamath committee appointed by the rbi to look into the stress of corporates following the covid 19 pandemic came up with their recommendations.

The committee will. They are however sceptical of whether the lenders would exercise the restructuring option and pass on the benefits. The committee is tasked to recommend parameters for one time restructuring of corporate loans. The k v kamath committee s recommendations on loan restructuring are likely to offer some relief to the hospitality sector that is now staring at a debt pile say hotel executives.

The reserve bank of india rbi constituted an expert committee under the chairmanship of veteran banker k v. Kamath to make recommendations on the required financial parameters to be factored in the resolution plans under the resolution framework for covid19 related stress along with sector specific benchmark ranges for such parameters. The reserve bank of india on friday announced the names of the members for the committee constituted under the chairmanship of k v. Kamath to make recommendations on the required financial parameters to be factored in the debt resolution plans on thursday the central bank announced a resolution framework for covid19 related stress as a special window under the prudential.

The committee will formulate sector specific resolution plans for all accounts with total loan exposure of rs 1 500 crore and. The supreme court recently asked the centre and the reserve bank of india about the steps taken to implement the k v. While the six month moratorium on loan repayments ended on august 31 the rbi has allowed banks to recast loans which were classified as standard as on march 1 2020.