K V Kamath Committee Report

Kamath on restructuring of loans impacted by the covid 19 pandemic.

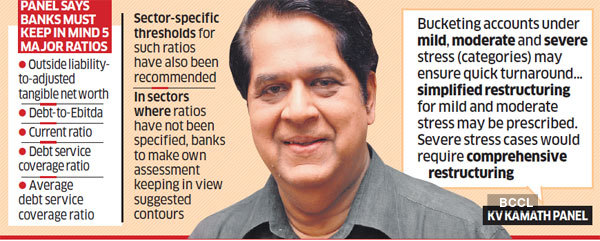

K v kamath committee report. Kamath to make recommendations on the required financial parameters to be factored in the resolution plans under the resolution framework for covid19 related stress along with sector specific benchmark ranges for such parameters. Various writ petitions have been filed in the court highlighting the plight of borrowers small and big who were being charged compound interest post the. From rbi web site the reserve bank had on august 7 2020 announced the constitution of an expert committee under the chairmanship of shri k v. Recently a five member expert committee headed by k v kamath has come out with recommendations on the financial parameters required for a one time loan restructuring window for corporate borrowers under stress due to the pandemic.

Constituted to make recommendations on norms for the resolution of covid 19 related stressed loans. The committee will formulate sector specific resolution plans for all accounts with total loan exposure of rs 1 500 crore and. On september 4 the k v kamath committee appointed by the rbi to look into the stress of corporates following the covid 19 pandemic came up with their recommendations. About k v kamath committee report.

It is a committee constituted by the reserve bank of india rbi. 1 shri k v kamath chairperson 2 shri diwakar gupta member effective september 1 2020 3 shri t n manoharan member effective august 14 2020 4 shri ashvin parekh member. Leverage liquidity debt serviceability. Background of k v kamath committee.

The committee is tasked to recommend parameters for one time restructuring of corporate loans. The panel tabled its report on september 4 wherein it has suggested financial parameters that include aspects related to leverage liquidity and debt serviceability. Why kamath panel report is in the news. The reserve bank of india rbi has set up a committee headed by k v.