K V Kamath Committee Report Upsc

Manoharan ashvin parekh and sunil mehta ceo of indian banks association as the member secretary.

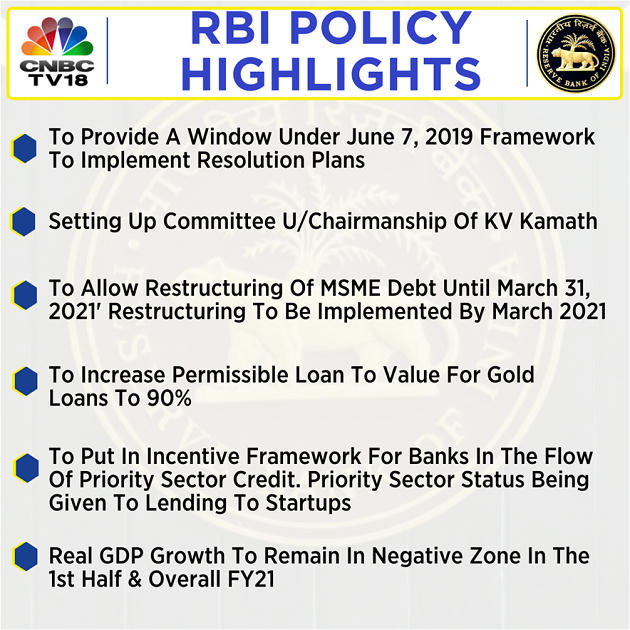

K v kamath committee report upsc. Various writ petitions have been filed in the court highlighting the plight of borrowers small and big who were being charged compound interest post the. Constituted to make recommendations on norms for the resolution of covid 19 related stressed loans. The reserve bank of india rbi has set up a committee headed by k v. Background of k v kamath committee.

The reserve bank of india had constituted an expert committee under the chairmanship of k v. Recently a five member expert committee headed by k v kamath has come out with recommendations on the financial parameters required for a one time loan restructuring window for corporate borrowers under stress due to the pandemic. The committee will formulate sector specific resolution plans for all accounts with total loan exposure of rs 1 500 crore and. The other members of the committee include diwakar gupta t n.

Kamath committee report on recommendations to bail out sectors affected by the covid 19 pandemic. Sri k v kamath committee report decoded. The committee will submit its recommendations on the financial parameters to the rbi which in turn will notify the same along with modifications if any in 30 days. The indian banks association iba will function as.

The supreme court has asked the centre and the reserve bank of india about the steps taken to implement the k v. Kamath to make recommendations on norms for the resolution of covid 19 related stressed loans. The supreme court recently asked the centre and the reserve bank of india about the steps taken to implement the k v. You have 2000 characters left.

About k v kamath committee report. Kamath committee submitted its report on september 4 2020. 8 th august 2020 cna. Kamath committee report on recommendations to bail out sectors affected by the covid 19 pandemic.

Kamath on restructuring of loans impacted by the covid 19 pandemic. Why kamath panel report is in the news. The supreme court recently asked the centre and the reserve bank of india about the steps taken to implement the k v. The panel tabled its report on september 4 wherein it has suggested financial parameters that include aspects related to leverage liquidity and debt serviceability.

The reserve bank of india rbi had constituted the proposed expert committee under the chairmanship of k v. It is a committee constituted by the reserve bank of india rbi. Various writ petitions have been filed in the court highlighting the plight of borrowers small and big who were being charged compound interest post the. The reserve bank of india rbi on 4 th sept set up a 5 member expert committee under banker k v kamath to suggest financial parameters for resolution of corona related stressed assets.

The committee is tasked to recommend parameters for one time restructuring of corporate loans. While the six month moratorium on loan repayments ended on august 31 the rbi has allowed banks to recast loans which were classified as standard as on march 1 2020. Kindly do not post any personal abusive defamatory infringing obscene indecent discriminatory or unlawful or similar.

4.png)